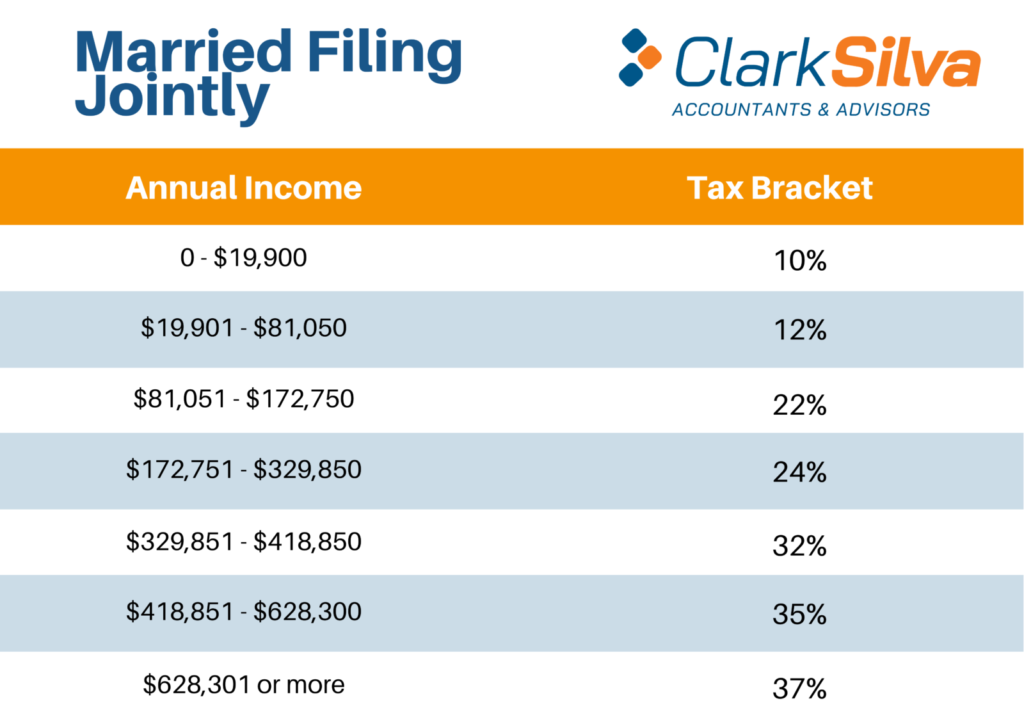

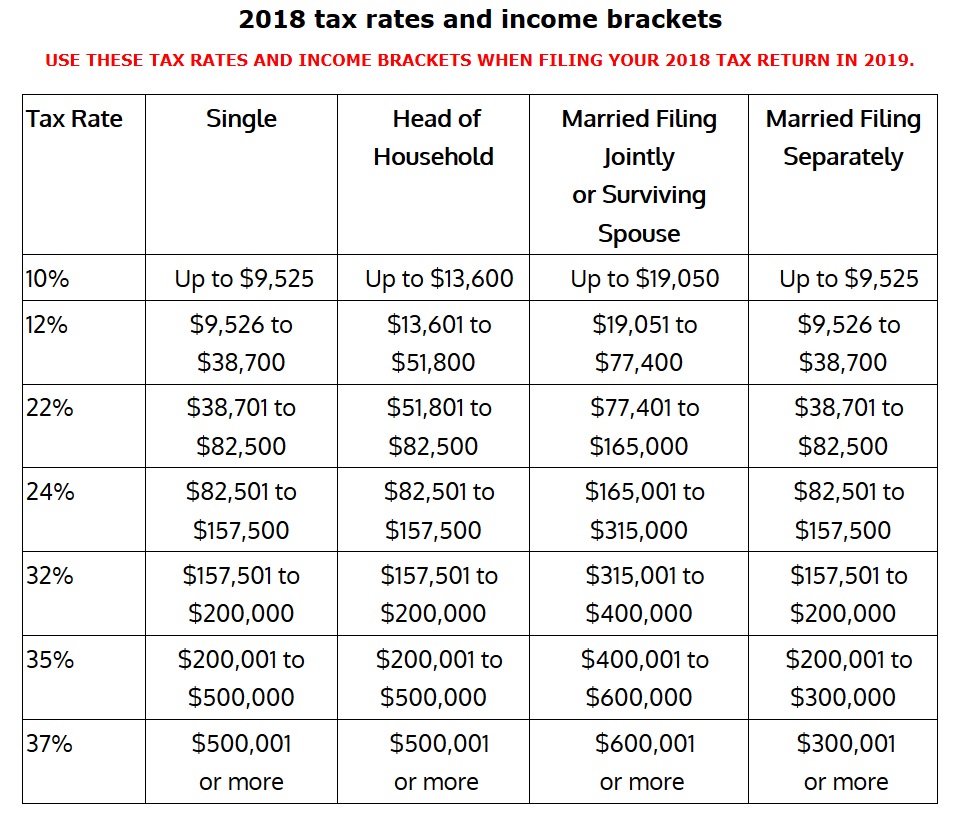

Qualified Business Income Deduction (Sec. Source: “2020 Tax Brackets,” Tax Foundation and IRS Topic Number 559 2020 Capital Gains Tax Rates (Long Term Capital Gains) Long-term capital gains are taxed using different brackets and rates than ordinary income. However, the refundable portion of the Child Tax Credit is adjusted for inflation but will remain at $1,4.Ĭapital Gains Tax Rates (Long Term Capital Gains) The child tax credit totals at $2,000 per qualifying child and is not adjusted for inflation. All these are relatively small increases from 2019. The maximum credit is $3,584 for one child, $5,920 for two children, and $6,660 for three or more children. The maximum Earned Income Tax Credit in 2020 for single and joint filers is $538, if there are no children (Table 5). 2020 Alternative Minimum Tax Exemption Phaseout Thresholds In 2020, the exemption will start phasing out at $518,400 in AMTI for single filers and $1,036,800 for married taxpayers filing jointly (Table 4). In 2020, the 28 percent AMT rate applies to excess AMTI of $197,900 for all taxpayers ($98,950 for married couples filing separate returns).ĪMT exemptions phase out at 25 cents per dollar earned once taxpayer AMTI hits a certain threshold. The AMT exemption amount for 2020 is $72,900 for singles and $113,400 for married couples filing jointly (Table 3). The AMT is levied at two rates: 26 percent and 28 percent. However, this exemption phases out for high-income taxpayers. To prevent low- and middle-income taxpayers from being subjected to the AMT, taxpayers are allowed to exempt a significant amount of their income from AMTI. The AMT uses an alternative definition of taxable income called Alternative Minimum Taxable Income (AMTI). The taxpayer then needs to pay the higher of the two. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT. The Alternative Minimum Tax (AMT) was created in the 1960s to prevent high-income taxpayers from avoiding the individual income tax. The personal exemption for 2020 remains eliminated. The standard deduction for single filers will increase by $200, and by $400 for married couples filing jointly (Table 2). Standard Deduction and Personal Exemption The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $518,400 and higher for single filers and $622,050 and higher for married couples filing jointly.Ģ020 Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households Rateįor Married Individuals Filing Joint Returns In 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). 2020 Federal Income Tax Brackets and Rates However, with the Tax Cuts and Jobs Act of 2017, the IRS will now use the Chained Consumer Price Index (C-CPI) to adjust income thresholds, deduction amounts, and credit values accordingly. The IRS used to use the Consumer Price Index (CPI) to calculate the past year’s inflation. This is done to prevent what is called “ bracket creep,” when people are pushed into higher income tax brackets or have reduced value from credits and deductions due to inflation, instead of any increase in real income. 14, 2018).įor information about the federal income tax deductions, please visit the IRS website.On a yearly basis the IRS adjusts more than 40 tax provisions for inflation. You cannot deduct anything above this amount. The limit is $10,000 - $5,000 if married filing separately. Your deduction for state and local income, sales, and property taxes is limited to a combined total deduction.

If you keep all your receipts, you can deduct actual sales and use tax you paid during the tax year. If you did not keep receipts, the IRS provides an online Sales Tax Deduction Calculator to determine the amount of optional general sales tax you can claim, or you can use the Optional State Sales Tax Tables. (This does not apply if you take the standard deduction.)

If you qualify to itemize your deductions on Form 1040, Schedule A, you can take this deduction. You may continue to itemize and deduct sales tax on your 2018 federal income tax returns. Businesses that make retail sales or provide retail services may be required to collect and submit retail sales tax (see Marketplace Fairness – Leveling the Playing Field).įederal sales tax deduction for tax year 2018 The business’s gross receipts determine the amount of tax they are required to pay. However, people or businesses that engage in business in Washington are subject to business and occupation (B&O) and/or public utility tax. Washington state does not have a personal or corporate income tax.

0 kommentar(er)

0 kommentar(er)